Why In News?

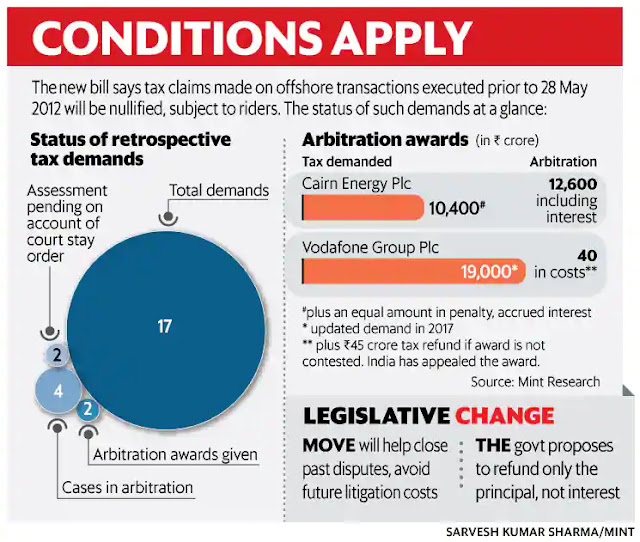

The government has proposed to withdraw the infamous retrospective tax law, which hounded big foreign companies including Vodafone and Cairn Energy with billions of dollars of tax demands.

- The retrospective tax rule was an amendment to the Income-Tax Act, 1961, which received the President’s assent in May 2012, allowing the government to ask companies to pay taxes on mergers and acquisitions that happened before that date

The move comes after India lost international arbitration with Cairn, and just ahead of a similar arbitration ruling in Vodafone case over a similar demand.

- The bill, introduced in Lok Sabha today, proposed to withdraw the law that allowed the government to raise tax demands with retrospective effect for the sale of assets before May 2012.

Demands made shall be nullified

- Fresh bill introduced today proposed that no tax demand shall be raised in future on the basis of the said retrospective amendment for any indirect transfer of Indian assets if the transaction was undertaken before 28th May, 2012.

- The bill adds that demand raised for indirect transfer of Indian assets made before May 2012 shall be nullified on fulfilment of specified conditions

What Is Retrospective Tax?

As the name suggests, retrospective taxation allows a country to pass a rule on taxing certain products, items or services and deals and charge companies from a time behind the date on which the law is passed.

- Ideally, retrospective tax is to make adjustments when policies in the past and the present are so vastly different that tax paid before under the old policy could be said to have been less.

- Retrospective tax could correct that situation by charging tax under the existing policy.

- However, retrospective tax faces resistance because taxpayers would have paid under the earlier regime by complying with the rules at that time, and taking into account their entire budgeting ecosystem.

- Prudent financial management may get disrupted when retrospective tax is charged since taxpayers would be paying an additional amount.

The most controversial retrospective tax amendment in India is the 2012 version, which said tax is payable on indirect transfer of Indian assets before May 2012.

Image Source : The Hindu Business Line

Retrospective taxation: the Vodafone case, and the Hague court ruling

Permanent Court of Arbitration at The Hague in Sep 2020 ruled that India’s retrospective demand of Rs 22,100 crore as capital gains and withholding tax imposed on the British telecommunication company for a 2007 deal was “in breach of the guarantee of fair and equitable treatment”.

|

| Image Source : Business Standard |

Background:

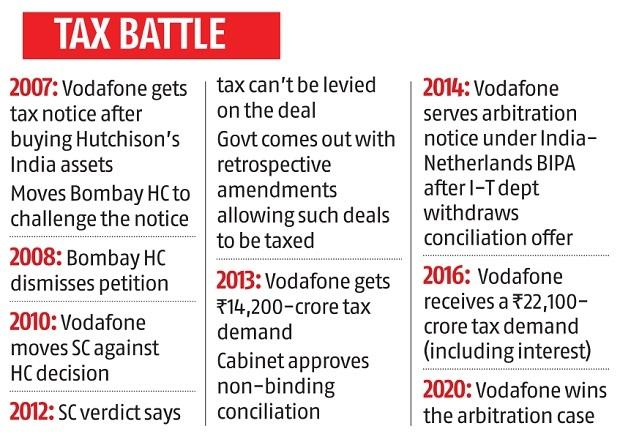

In May 2007, Vodafone had bought a 67% stake in Hutchison Whampoa for $11 billion. This included the mobile telephony business and other assets of Hutchison in India.

In September that year, the India government for the first time raised a demand of Rs 7,990 crore in capital gains and withholding tax from Vodafone, saying the company should have deducted the tax at source before making a payment to Hutchison.

Vodafone challenged the demand notice in the Bombay High Court, which ruled in favour of the Income Tax Department. Subsequently, Vodafone challenged the High Court judgment in the Supreme Court, which in 2012 ruled that Vodafone Group’s interpretation of the Income Tax Act of 1961 was correct and that it did not have to pay any taxes for the stake purchase.

The same year, the then Finance Minister, the late Pranab Mukherjee, circumvented the Supreme Court’s ruling by proposing an amendment to the Finance Act, thereby giving the Income Tax Department the power to retrospectively tax such deals. The Act was passed by Parliament that year and the onus to pay the taxes fell back on Vodafone. The case had by then become infamous as the ‘retrospective taxation case’.

By 2014, all attempts by the telco and the Finance Ministry to settle the issue had failed. Vodafone Group then invoked Clause 9 of the Bilateral Investment Treaty (BIT) signed between India and the Netherlands in 1995.

What is the Bilateral Investment Treaty?

- On November 6, 1995, India and the Netherlands had signed a BIT for promotion and protection of investment by companies of each country in the other’s jurisdiction.

- Among the various agreements, the treaty had then stated that both countries would strive to “encourage and promote favorable conditions for investors” of the other country.

- The two countries would, under the BIT, ensure that companies present in each other’s jurisdictions would be “at all times be accorded fair and equitable treatment and shall enjoy full protection and security in the territory of the other”.

Retrospective taxation: the Cairn case, and the Hague court ruling

Permanent Court of Arbitration (PCA) has ruled that the Indian government was wrong in applying a retrospective tax on energy giant Cairn Plc.

Background:

In 2006-07, Cairn UK transferred shares of Cairn India Holdings to Cairn India on which Income Tax authorities slapped a tax demand of Rs. 24,500 crore as it contended that Cairn UK had made capital gains.

Owing to different interpretations of capital gains, the company refused to pay the tax, which prompted cases being filed at the Income Tax Appellate Tribunal (ITAT) and the Delhi High Court.

In 2012, Indian government’s budget retrospectively amended the tax code, giving itself the power to go after mergers and acquisitions (M&A) deals all the way back to 1962 if the underlying asset was in India.

In 2015, Cairn Energy Plc commenced international arbitration proceedings against the Indian government.

PCA Ruling in Cairn Case

- The Indian government must pay roughly Rs. 8,000 crore in damages to Cairn.

- Cairn Tax Issue was not just a tax-related issue but an investment-related dispute, and therefore the issue comes under its jurisdiction.

- The Indian government’s retrospective demand was in breach of the guarantee of fair and equitable treatment.

- The Centre had failed to uphold its obligations under the UK-India Bilateral Investment Treaty and international laws in seeking tax payments from the company for its business reorganization in the country.

The "Taxation Laws (Amendment) Bill 2021" introduced in Lok Sabha is basically on that line and will withdraw the law that allowed the government to raise tax demands with retrospective effect for the sale of assets before May 2012.

- Administrative Council - to oversee its policies and budgets,

- Members of the Court - a panel of independent potential arbitrators, and

- International Bureau - its Secretariat, headed by the Secretary-General.