What scale-based regulation for NBFCs? Learn about Non-Banking Financial Institutions in India for RBI Grade B, UPSC Exam in Detail.

The contribution of NBFCs towards supporting real economic activity and their role as a supplemental channel of credit intermediation alongside banks is well recognized. Over the years, the sector has undergone considerable evolution in terms of size, complexity, and interconnectedness within the financial sector.

Non-banking financial institutions (NBFIs) regulated by the Reserve Bank comprises NBFCs, HFCs, AIFIs and primary dealers (PDs).

- NBFCs comprise government/ public/ private limited companies which provide niche financing to various sectors of the economy, ranging from real estate and infrastructure to agriculture and micro loans, thereby supplementing bank credit.

- HFCs specialize in providing housing finance to individuals, co-operative societies and corporate bodies to support housing activity in the country

- AIFIs, i.e., the National Bank for Agriculture and Rural Development (NABARD), the Export Import Bank of India (EXIM Bank), the Small Industries Development Bank of India (SIDBI), the National Housing Bank (NHB) and the recently established National Bank for Financing Infrastructure and Development (NaBFID), are the apex financial institutions which provide long-term funding to agriculture, foreign trade, small industries, housing finance companies and infrastructure, respectively.

- PDs ensure subscription to primary issuances of government securities (G-secs), besides acting as market makers in the G-sec market.

Non-Banking Financial Companies (NBFCs)

- NBFC or Non-Banking Financial Institutions are the institutions that have been registered under the Companies Act, 1956. NBFCs offer bank-related services without having banking licenses.

- NBFCs are not banks, but their activities include lending and other activities such as providing loans and advances, credit facilities, savings and investment products, trading in the money market, managing stock portfolios, money transfers, and so on.

- Their activities include hiring, leasing, infrastructure finance, venture capital finance, housing finance, and so on.

- Deposits can be accepted by NBFC, but only term deposits and deposits repayable on demand is not accepted.

- NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself.

- Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors.

Functions of NBFCs in India

Retail Financing: Entities that offer short-term funds for loans against gold, shares, property, majorly for consumption purposes.

Infrastructural Funding: This is the most significant section where foremost Non-Banking Financial Companies deal in. A lot part of this segment alone makes up a significant portion of funds lent amongst the different segments. This mainstream comprises Railways or Metros, Real Estate, Ports, Flyovers, Airports, etc.

Hire Purchase Services: It’s a way through which the seller provides the products or goods to the buyer without transferring the goods’ ownership. The payment of the goods is made in instalments. Once the buyer pays all the instalments of the goods or products, the ownership of the good is automatically transferred to the buyer.

Trade Finance: Entities dealing in distributor or dealer finance so that they can for vendor finance, working capital requirements, & other business loans.

Asset Management Companies: Asset Management Companies (AMCs) are those companies that include fund managers (who invest inequity shares to gain good gains) who invest the funds pooled by small investors & actively manage it.

Venture Capital Services: The entities that invest in small businesses are at their starting stage, but their accomplishment rate is high and is capable enough for adequate return in the coming time.

Leasing Services: The entities that deal in leasing or for a good understanding of this word we can recognize it in such a way that the way we rent a property or flat for living similarly these entities offer the property to small businesses or sometimes even larger ones who cannot afford it for whatsoever reason. The only difference between leasing & renting is that leasing contracts are made for a fixed period of time.

Importance of NBFC

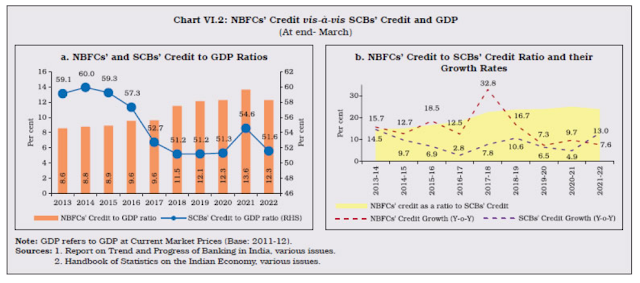

The growing importance of the NBFC sector in the Indian financial system is reflected in the consistent rise of NBFCs’ credit as a proportion to GDP as well as in relation to credit extended by scheduled commercial banks (SCBs).

- NBFCs play an important role in developing countries like India, where access to bank finance remains a challenge for a large portion of the population and businesses.

- Nonbanking financial institutions, including NBFCs in India, provide services to market segments that commercial banks do not serve due to higher risk and lower returns.

- Nonbanking financial institutions are an essential part of an economy's financial sector due to their inherent characteristics.

Scale Based Regulation (SBR) Framework

- In terms of size, NBFC-BL comprises all NBFCs-ND with asset size below ₹1,000 crore.

- NBFCs-ND with asset size above ₹1,000 crore and NBFCs-D are put in NBFC-ML.

- NBFC-UL comprises those NBFCs (including NBFCs-D) which are specifically monitored by the Reserve Bank on the basis of a set of parameters and scoring methodology.

- The framework also envisages that top ten eligible NBFCs in terms of their asset size shall always reside in NBFC-UL. Accordingly, the Reserve Bank has identified and placed 16 NBFCs (including HFCs) in NBFC-UL.

- NBFC-TL shall ideally remain empty and will be populated if the Reserve Bank perceives a substantial increase in the potential systemic risk from specific NBFCs in NBFC-UL.

- The Base Layer shall comprise of (a) non-deposit taking NBFCs below the asset size of ₹1000 crore and (b) NBFCs undertaking the following activities- (i) NBFC-Peer to Peer Lending Platform (NBFC-P2P), (ii) NBFC-Account Aggregator (NBFC-AA), (iii) Non-Operative Financial Holding Company (NOFHC) and (iv) NBFCs not availing public funds and not having any customer interface1.

- The Middle Layer shall consist of (a) all deposit taking NBFCs (NBFC-Ds), irrespective of asset size, (b) non-deposit taking NBFCs with asset size of ₹1000 crore and above and (c) NBFCs undertaking the following activities (i) Standalone Primary Dealers (SPDs), (ii) Infrastructure Debt Fund - Non-Banking Financial Companies (IDF-NBFCs), (iii) Core Investment Companies (CICs), (iv) Housing Finance Companies (HFCs) and (v) Infrastructure Finance Companies (NBFC-IFCs).

- The Upper Layer shall comprise of those NBFCs which are specifically identified by the Reserve Bank as warranting enhanced regulatory requirement based on a set of parameters and scoring methodology as provided by RBI. The top ten eligible NBFCs in terms of their asset size shall always reside in the upper layer, irrespective of any other factor.

- The Top Layer will ideally remain empty. This layer can get populated if the Reserve Bank is of the opinion that there is a substantial increase in the potential systemic risk from specific NBFCs in the Upper Layer. Such NBFCs shall move to the Top Layer from the Upper Layer.

| Classification of NBFCs by Activity under the New Regulatory Framework | ||

| Type of NBFC | Activity | Layer |

| 1. NBFC-Investment and Credit Company (NBFC-ICC) | Lending and investment. | Any layer, depending on the parameters of the scale based regulatory framework. |

| 2. NBFC-Infrastructure Finance Company (NBFC-IFC) | Financing of infrastructure sector. | Middle layer or Upper layer, as the case may be. |

| 3. Core Investment Company (CIC) | Investment in equity shares, preference shares, debt, or loans of group companies. | Middle layer or Upper layer, as the case may be. |

| 4. NBFC-Infrastructure Debt Fund (NBFC-IDF) | Facilitation of flow of long-term debt only into post commencement operations in infrastructure projects which have completed at least one year of satisfactory performance. | Middle layer |

| 5. NBFC-Micro Finance Institution (NBFC-MFI) | Providing collateral free small ticket loans to low income households. | Any layer, depending on the parameters of the scale based regulatory framework. |

| 6. NBFC-Factors | Acquisition of receivables of an assignor or extending loans against the security interest of the receivables at a discount. | Any layer, depending on the parameters of the scale based regulatory framework. |

| 7. NBFC-Non-Operative Financial Holding Company (NBFC-NOFHC) | Facilitation of promoters/ promoter groups in setting up new banks. | Base layer |

| 8. NBFC-Mortgage Guarantee Company (NBFC-MGC) | Undertaking of mortgage guarantee business. | Any layer, depending on the parameters of the scale based regulatory framework. |

| 9. NBFC-Account Aggregator (NBFC-AA) | Collecting and providing a customer’s financial information in a consolidated, organised, and retrievable manner to the customer or others as specified by the customer. | Base layer |

| 10. NBFC–Peer to Peer Lending Platform (NBFC-P2P) | Providing an online platform to bring lenders and borrowers together to help mobilise funds. | Base layer |

| 11. Housing Finance Company (HFC) | Financing for purchase/ construction/ reconstruction/ renovation/ repairs of residential dwelling units. | Middle layer or Upper layer, as the case may be. |

| Notes: 1. Standalone Primary Dealers (SPDs) lie in the middle layer. 2. Government NBFCs lie in either base or middle layer. Source: RBI. | ||

The Reserve Bank also specified a Prompt Corrective Action (PCA) framework for NBFCs in the middle and upper layers to further strengthen its oversight over these segments

| Risk Thresholds defined under PCA Framework for NBFCs-ND-SI and NBFCs-D. | |||

| Indicator | RT-1 | RT-2 | RT-3 |

| CRAR | Less than the regulatory minimum of 15 per cent but greater than or equal to 12 per cent. | Less than 12 per cent but greater than or equal to 9 per cent. | Less than 9 per cent. |

| Tier-I Capital Ratio | Less than the regulatory minimum of 10 per cent but greater than or equal to 8 per cent. | Less than 8 per cent but greater than or equal to 6 per cent. | Less than 6 per cent. |

| NNPA Ratio | Greater than 6 per cent but less than or equal to 9 per cent. | Greater than 9 but less than or equal to 12 per cent. | Greater than 12 per cent. |

- Minimum Capital Requirements - No company can carry out NBFC business without obtaining Certificate of Registration from RBI.

- The current regulatory guidelines mandate that only those companies with minimum net owned funds (NOF) of ₹10 crore can commence the activities of NBFCs

- The existing NBFCs-ICC, NBFCs-MFI and NBFC-Factors are required to attain NOF of ₹10 crore by March 2027 following a glide-path.

| Type of NBFC | Minimum Net Owned Fund |

|---|---|

| NBFCs other than mentioned below | ₹ 2 crore |

| NBFC-MFI | ₹ 5 crore |

| NBFC- MFI in NE Region | ₹ 2 crore |

| NBFC- Factor | ₹ 5 crore |

| NBFC-HFC | ₹ 20 crore |

| NBFC-MGC | ₹ 100 crore |

| IDF - NBFC | ₹ 300 crore |

| NBFC- IFC | ₹ 300 crore |

| NBFCs | Current NOF | By March 31, 2025 | By March 31, 2027 |

| NBFC-ICC | ₹2 crore | ₹5 crore | ₹10 crore |

| NBFC-MFI | ₹5 crore (₹2 crore in NE Region) | ₹7 crore (₹5 crore in NE Region) | ₹10 crore |

| NBFC-Factors | ₹5 crore | ₹7 crore | ₹10 crore |

| NPA Norms | Timeline |

| >150 days overdue | By March 31, 2024 |

| >120 days overdue | By March 31, 2025 |

| > 90 days | By March 31, 2026 |

| NBFC (as a percentage of Owned Funds)* | Banks (as a percentage of the Capital Base i.e. Tier I Capital) | ||||

|---|---|---|---|---|---|

| Lending | Investment | Total | Exposure | ||

| Single borrower/ counterparty | 15 | 15 | 25 | Single Counterparty | 20# |

| Group of borrowers/ parties | 25 | 25 | 40 | Groups of connected counterparties (using control and economic interdependence criteria) | 25 |

| * NBFC may exceed the concentration of credit / investment norms, by 5 per cent for any single party and by 10 per cent for a single group of parties, if the additional exposure is on account of infrastructure loan and / or investment. Further, concentration of credit / investment norms do not apply to NBFCs that do not issue guarantees and do not directly/ indirectly access public funds in India. #In exceptional cases, Board of banks may allow an additional 5 percent exposure of the bank’s available eligible capital base. | |||||

- Internal capital can be assessed based on it by factoring credit, market, operational, and all other residual risks.

- The objective of ICAAP is to ensure availability of adequate capital to support all risks in the business as also to encourage NBFC to develop and use better risk management techniques for monitoring and managing their risks.

- This will also include an active dialogue between the Reserve Bank and the NBFCs, wherein the supervisor will have the freedom to review and evaluate the NBFCs’ internal capital adequacy assessments and strategies, as well as their ability to monitor and ensure compliance with the regulatory capital ratios.

- Supervisors can take appropriate supervisory action if they are not satisfied with the result of this process, which may include prescription of additional capital to be maintained.

- This would be of significance as NBFCs have different business models and hence one-size-fits-all approach may not be feasible, and, here, supervisory judgment will play an important role.

- The CCO shall have direct reporting lines to the MD & CEO and/or Board/Board Committee (ACB) of the NBFC. In case the CCO reports to the MD & CEO, the Audit Committee of the Board shall meet the CCO quarterly on one-to-one basis, without the presence of the senior management including MD & CEO. The CCO shall not have any reporting relationship with the business verticals of the NBFC and shall not be given any business targets. Further, the performance appraisal of the CCO shall be reviewed by the Board/ACB.

- The guidelines may be suitably calibrated for NBFCs in the Middle Layer by prescribing, at the minimum, a) constitution of a Remuneration Committee, b) principles for fixed/ variable pay structures, and c) malus/ claw back requirements.

- The Nomination and Remuneration Committee will ensure that there is no conflict of interest in appointment of directors and their independence is not subject to potential threats.

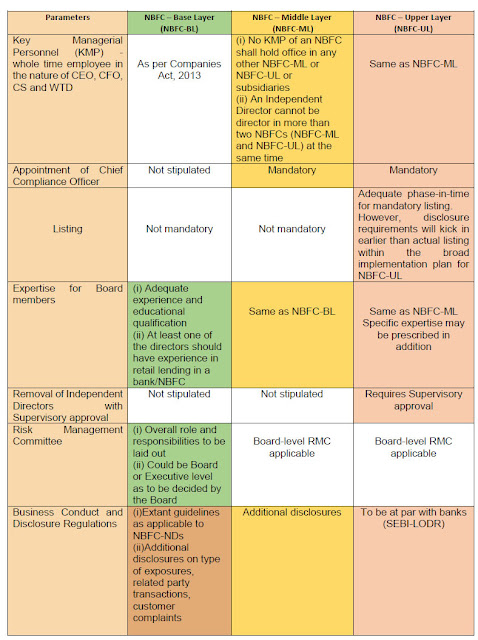

- In order to ensure that there is no conflict arising out of independent directors being on the Board of various NBFCs at the same time, including those of competing NBFCs, it is proposed that an independent director shall not be on the board of more than two NBFCs (NBFC-ML and NBFC-UL) in total.

- The onus of ensuring that there is no conflict, will lie with the Board of the NBFC.

- Corporate Governance report like composition and category of directors, relationship between directors, shareholding of non-executive directors, etc.

- Disclosure on modified (i.e. non-clean) opinion expressed by auditors, its impact on various financial items and views of management on audit qualifications.

- Items of income and expenditure of exceptional nature.

- Breach in terms of covenants, incidence/s of default

- Divergence in asset classification and provisioning based on inspection findings

- Compliance certificates by Chief Executive Officer and Chief Financial Officer covering various aspects including financial statements, absence of fraudulent/ illegal transactions, submissions to auditors, etc.

- Requirements for Secretarial Audit.

- Obligations of independent directors, senior management, key management personnel, directors and promoters

- Limits on directorships/ membership of committees of listed entities

- Role of various committees (Audit Committee, Nomination and Remuneration Committee, Stakeholder’s relationship, Risk Management) and review of information by Audit Committee

- Vigil mechanism and requirements pertaining to related party transactions.

- Corporate Governance requirements for subsidiaries of listed entities.

- Number for NBFCs which will reside in this layer would be dependent upon the composite score thrown by the parametric analysis. It may, however, be recalled that the top ten NBFCs (in terms of their asset size) will anyway reside in this layer, irrespective of any other factor.

- It is expected that a total of not more than 25 to 30 NBFCs will occupy this layer. The nomenclature of NBFCs identified in this layer shall be termed as NBFC-Upper Layer (NBFC-UL).

- In view of their large systemic significance and scale of operations, the regulation of NBFC-UL will be tuned on similar lines as those for banks, though providing for the unique business model of the NBFCs as also preserving flexibility of their operations. The suggested additional regulatory tools are mentioned below.

- Capital Requirements: Scheduled commercial banks are on a Basel III framework which provides for minimum requirements for Common Equity Tier 1 (CET 1) capital. It is felt that CET 1 could be introduced for NBFC-UL to enhance the quality of regulatory capital. It is proposed that CET 1 may be prescribed at 9% within the Tier I capital.

- Leverage: In addition to the CRAR requirements, NBFCs will also be subjected to a leverage requirement to ensure that the growth of the NBFC is supported by adequate capital. A suitable ceiling for leverage will be prescribed for these entities, which would act as a backstop for further growth of the NBFCs to a desired level.

- Standard asset provisioning: Systemically important NBFCs are currently subject to a flat rate of 0.40% as standard asset provision whereas, banks are subjected to differential rate of standard asset provisioning. (for example: farm credit and SME@ 0.25%, CRE @ 1.00%, CRE-RH @ 0.75%, and all other loans 0.40 %). In order to tune the regulatory framework for NBFC-UL to greater sensitivity, it is suggested that NBFCs falling in Upper Layer are prescribed differential standard asset provisioning on lines of banks. These NBFCs are already under Ind AS and the accounting standards demand allowances based on 12-month expected credit losses in place of standard asset provisioning. However, NBFCs must reckon differential standard asset provisioning to arrive at the prudential floor envisaged under regulatory guidelines for implementation of Indian accounting Standards.

- Further, in view of the higher systemic risk posed by NBFC-UL, the LEF as applicable to banks, can be extended with suitable adaptation (to take care of heterogeneity and flexibility of operations of the NBFCs) along with a transition time for implementation.

- Industry has traditionally remained the largest recipient of credit from the NBFC sector, followed by retail, services and agriculture.

- In 2021-22, credit growth to industry and retail sectors was subdued relative to the previous year, while credit to the service sector exhibited double digit growth.

- During 2021-22, while banks’ credit to industry and services sector benefitted from a favorable base effect, it is the retail segment in which banks outperformed NBFCs

- Within industry, about 86 per cent of industrial credit goes to infrastructure, which grew at just 1.6 per cent in 2021-22 dragging down the overall credit growth.

- NBFCs also play a crucial role in bridging the credit needs of micro, small and medium enterprises (MSMEs), primarily those engaged in services

- The emergency credit line guarantee scheme (ECLGS) launched by the government in May 2020 helped MSMEs to access enhanced credit. The co-lending model introduced by the Reserve Bank in November 2020 also improved the flow of credit to the MSME sector. Subsequently, the Union Budget 2022-23 has extended the ECLGS up to March 2023, with the guarantee cover raised by ₹50,000 crores to a total of ₹5 lakh crores.