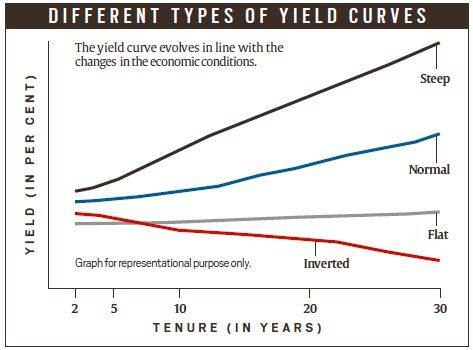

Inversion in the yield curve means yield on the shorter and medium term G-Secs exceed the longer term ones. The last weekly auction of Government Securities (G-Secs) in the current financial year sailed through, but the yield curve became inverted, with the cut-off yield on the six-year and 13-year papers coming in higher than the 39-year paper.

Why In News?

G-Sec auction: Yield curve becomes inverted (BL News on 25th Feb 2023)

- The last weekly auction of Government Securities (G-Secs) in the current financial year sailed through, but the yield curve became inverted, with the cut-off yield on the six-year and 13-year papers coming in higher than the 39-year paper.

What Is an Inverted Yield Curve?

- An inverted yield curve occurs when short-term debt instruments have higher yields than long-term instruments of the same credit risk profile.

- Usually, the yield curve slopes upward, reflecting the fact that holders of longer-term debt have taken on more risk.

- A yield curve inverts when long-term interest rates drop below short-term rates, indicating that investors are moving money away from short-term bonds and into long-term ones. This suggests that the market as a whole is becoming more pessimistic about the economic prospects for the near future.

- In the US, the curve has been inverted over the last six months or so... In India, too, the curve has just got inverted.

What are bonds yields?

Simply put, the yield of a bond is the effective rate of return that it earns. But the rate of return is not fixed — it changes with the price of the bond.

Suppose the face value of a 10-year G-sec is Rs 100, and its coupon payment is Rs 5. Buyers of this bond will give the government Rs 100 (the face value); in return, the government will pay them Rs 5 (the coupon payment) every year for the next 10 years, and will pay back their Rs 100 at the end of the tenure. In this case, the bond’s yield, or effective rate of interest, is 5%. The yield is the investor’s reward for parting with Rs 100 today, but for staying without it for 10 years.

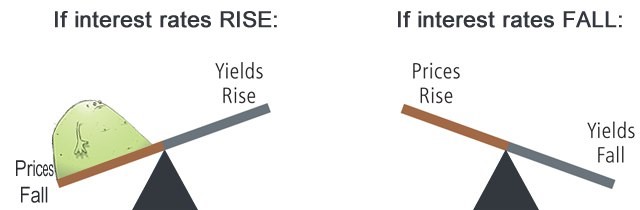

Why and how do yields go up and down?

Imagine a situation in which there is just one bond, and two buyers (or people willing to lend to the government). In such a scenario, the selling price of the bond may go from Rs 100 to Rs 105 or Rs 110 because of competitive bidding by the two buyers. Importantly, even if the bond is sold at Rs 110, the coupon payment of Rs 5 will not change. Thus, as the price of the bond increases from Rs 100 to Rs 110, the yield falls to 4.5%.

Lets Take another Example,

Suppose the value of a 10-year G-sec is Rs 100, and its coupon payment is Rs 10. It means buyers of this bond will give the government Rs.100 and In return, the government will pay them Rs 10 (the coupon payment) every year for the next 10 years. After 10 years buyer will also get Rs.100 from the government in return of the Bond.

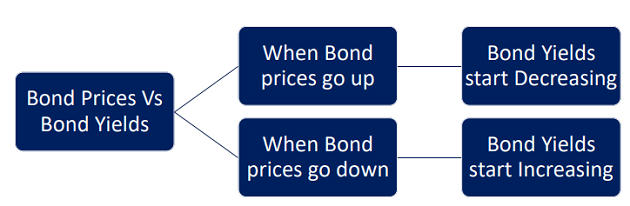

In the above example, the bond’s yield, or effective rate of interest, is 10%. Now suppose the GDP of the economy is going down and share market is plunging. In this case, investors will pull out their money from equity market and invest in safer instrument like Government bonds. Because of this, the demand for Government bond increases & the bond prices go up. Since the demand for bond has increased, the person who has government bond of Rs.100 will sell it for more than Rs.100

Suppose another person buys the same bond for Rs.110. It means this person will get the interest lower than 10%. Thus the bond yield decreases. In the similar way, when the economy is doing good, there will be less demand for bond. Thus the bond yield will start increasing. That's why Bond price is Inversely Proportional to Yield.

Similarly, if the interest rate in the broader economy is different from the initial coupon payment promised by a bond, market forces quickly ensure that the yield aligns itself with the economy’s interest rate. In that sense, G-sec yields are in close sync with the prevailing interest rate in an economy.

With reference to the first example, if the prevailing interest rate is 4% and the government announces a bond with a yield of 5% (that is, a face value of Rs 100 and a coupon of Rs 5) then a lot of people will rush to buy such a bond to earn a higher interest rate. This increased demand will start pushing up bond prices, even as the yields fall. This will carry on until the time the bond price reaches Rs 125 — at that point, a Rs-5 coupon payment would be equivalent to a yield of 4%, the same as in the rest of the economy.

- This process of bringing yields in line with the prevailing interest rate in the economy works in the reverse manner when interest rates are higher than the initially promised yields.

A yield curve is a graphical representation of yields for bonds (with an equal credit rating) over different time horizons. Typically, the term is used for government bonds — which come with the same sovereign guarantee. So the yield curve for Indian treasuries shows how yields change when the tenure (or the time for which one lends to the government) changes.

If bond investors expect the Indian economy to grow normally, then they would expect to be rewarded more (that is, get more yield) when they lend for a longer period. This gives rise to a normal — upward sloping — yield curve (see chart).

The steepness of this yield curve is determined by how fast an economy is expected to grow. The faster it is expected to grow the more the yield for longer tenures. When the economy is expected to grow only marginally, the yield curve is “flat”.

What is happening to Indian govt bond yields at present? What does it signify?

The global economy has been slowing down for the better part of the last two years. Some of the biggest economies are either growing at a slower rate (such as the US and China) or actually contracting (such as Germany).

The last weekly auction of Government Securities (G-Secs) in the current financial year sailed through, but the yield curve became inverted, with the cut-off yield on the six-year and 13-year papers (Short Term) coming in higher than the 39-year paper (Long Term).

Reason: Many Investors figured that if growth prospects are plummeting and RBI keep increasing rate of Interest then its wiser to Invest for Long term and so the demand for Long term Securities increased which raised the price and deceased the Yield for long term securities.

A yield inversion takes place when bond traders and investors expect uncertainty in the short to medium term and hence, prefer to park their money in long dated securities. Since they prefer to sell short and medium tenure bonds, the prices of these securities fall and yields rise. On the other hand, the buying of long maturity securities leads to rise in bond prices, which result in fall in yields.

According to economists, the recent surge in US yield against the backdrop of strong economic data enhances the probability of multiple rate hikes by the Fed. In response to that as there is a higher likelihood that the RBI may hike its repo rate further with recent surge in CPI (retail inflation) and lower to middle end of the yield curve having very little demand.

Significance of Lower Short and Mid Term Bond Yield: Why RBI wants moderate bond yields?

- Movements in yields, which depend on trends in interest rates, can result in capital gains or losses for investors. If an individual holds a bond carrying a yield of 6%, a rise in bond yields in the market will bring the price of the bond down. On the other hand, a drop in bond yield below 6% would benefit the investor as the price of the bond will rise, generating capital gains.

- A decline in yield is also better for the equity markets because money starts flowing out of debt investments to equity investments. That means as bond yields go down, the equity markets tend to outperform by a bigger margin and as bond yields go up equity markets tend to falter.

- In the past 5 years since late 2012, the benchmark 10-year yields are down by almost (- 17%) and have been moving consistently downward, despite occasional hiccups. At the same time, the Nifty is up by nearly 82%.

- When bond yields go up, it is a signal that corporates will have to pay a higher interest cost on debt. As debt servicing costs go higher, the risk of bankruptcy and default also increases and this typically makes mid-cap and highly leveraged companies vulnerable.

- The RBI has been aiming to keep yields lower as that reduces borrowing costs for the government while preventing any upward movement in lending rates in the market.

Reference Articles - Investopedia, IE, BL

.png)