What is ESG?

ESG is a combination of three words i.e. environment, social and governance.

ESG investing is used synonymously with sustainable investing or socially responsible investing. While selecting a stock for investment, the ESG fund shortlists companies that score high on environment, social responsibility and corporate governance, and then looks into financial factors.

Therefore, the key difference between the ESG funds and other funds is 'conscience' i.e the ESG fund focuses on companies with environment-friendly practices, ethical business practices and an employee-friendly record.

The United Nations Principles for Responsible Investment (UN-PRI) (an international organization) works to promote the incorporation of environmental, social, and corporate governance factors into investment decision-making.

ESG investing is also called as Sustainable responsible investing (SRI)

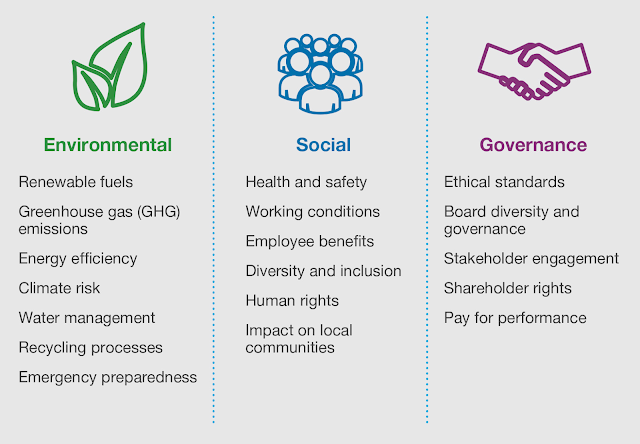

ESG’s three central factors are:

I. Environmental criteria, which examines how a business performs as a steward of our natural environment, focusing on:

- waste and pollution

- resource depletion

- greenhouse gas emission

- deforestation

- climate change

II. Social criteria, which looks at how the company treats people, and concentrates on:

- employee relations & diversity

- working conditions, including child labor and slavery

- local communities; seeks explicitly to fund projects or institutions that will serve poor and underserved communities globally

- health and safety

- conflict

III. Governance criteria, which examines how a corporation polices itself – how the company is governed, and focuses on:

- tax strategy

- executive remuneration

- donations and political lobbying

- corruption and bribery

- board diversity and structure

Why is it important?

ESG investing is based on the idea that only pressure from large investors can force the corporate world to behave responsibly from a social, environmental and governance perspective.

As ESG funds gain momentum in India, companies will be forced to follow better governance, ethical practices, environment-friendly measures and social responsibility.

Secondly, factors such as climate change, shifts in societal preferences and governance issues do pose risks to corporate earnings and thus to investors in stocks.

Companies that are aligned with ESG norms usually have lower risk of losses due to these factors.

Thus, investing in firms with a high ESG score in believed to translate into enhanced value for investors in the long run.

How big is ESG?

There are over 3,300 ESG funds globally and the number has tripled over the last decade. The value of assets applying ESG to investment decisions today is $40.5 trillion.

In India, as of now there are three schemes — SBI Magnum Equity ESG (Rs 2,772 crore), Axis ESG (Rs 1,755 crore) and Quantum India ESG Equity (Rs 18 cr) — following the ESG investment strategy.

Conclusion:

The big picture is that in the next few decades the global economy as well as Indian Economy is going to transform to a low-carbon economy and it will be one of the biggest investment events of our lifetime.

Companies that do not follow sustainable business models will find it tough to raise both equity and debt.

Globally, investors like pension funds, sovereign wealth funds etc. don’t invest in companies that are seen as polluting, don’t follow social responsibility or are tobacco companies.

Experts in the industry say there are conflicts at various levels and many investors worldwide who are looking at sustainable wealth creation do not wish to be associated with such conflicts.

- For example, while the global tobacco industry profits per year come to $35 billion, it is also a cause of nearly 6 million annual deaths and investors are growing sensitive to these realities.

Source : IE