Finance and Corporate Affairs Minister Nirmala Sitharaman, on Wednesday, launched the fifth edition of Enhanced Access and Service Excellence-EASE 5.0, which spells out the common reforms agenda for public sector banks (PSBs) under the EASENext program.

Under EASE 5.0, PSBs will continue to invest in new-age capabilities and deepen the ongoing reforms to respond to evolving customer needs, changing competition and the technology environment. EASE 5.0 will focus on digital customer experience, and integrated and inclusive banking, with emphasis on supporting small businesses and agriculture. Simultaneously, all PSBs will also create a bank-specific three-year strategic roadmap. It will entail strategic initiatives beyond EASE 5.0. The initiatives will be across diverse themes — business growth, profitability, risk, customer service, operations, and capability building.

FM launches EASE 5.0 'Common reforms agenda' for PSBs

Recently, Ministry of Finance launched EASENext reforms agenda for Public Sector Banks (PSBs).

- EASE 5.0 ‘Common reforms agenda’ of EASENext program has been developed for Public Sector Banks (PSBs).

- EASE Reforms entering its 5th edition as part of a bigger program of EASENext. 22 Action Points across multiple themes― Digital offerings for MSMEs, Retail and Agri customers, big data and analytics, tech capabilities, & governance

EASE Reforms:

As a part of Reform strategy of the governments 4R’s approach towards PSBs, it launched a common PSB reforms agenda for Enhanced Access and Service Excellence (EASE).

What do the 4 Rs stand for?

The Economic Survey 2015-16 has suggested a '4R' approach to comprehensively resolve the problem of India's ailing public sector banks (PSBs) and some corporate houses. The 4 R's include -- recognition, recapitalization, resolution and reform.

- Recognition: Banks must value their assets as far as possible close to true value as the RBI has been emphasizing.

- Re-capitalization: Once they do so, their capital position must be safeguarded via infusion of equity as the banks have been demanding.

- Resolution: The underlying stressed assets in the corporate sector must be sold or rehabilitated as the government has been desiring.

- Reform: Future incentives for the private sector and corporates must be set-right to avoid a repetition of the problem, as everyone has been clamoring.

It comprises of 30 Action plans across 6 themes including:

- Customer Responsiveness

- Responsible Banking

- Credit Off- take

- Udyam Mitra for MSMEs

- Deepening Financial Inclusion

- Digitalization and Developing Personnel for Brand PSBs

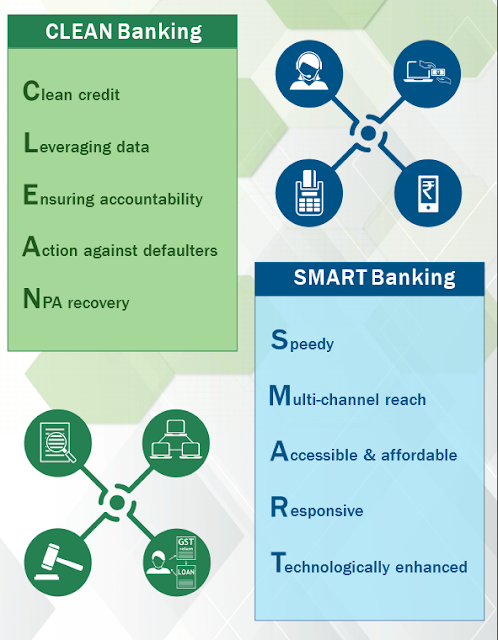

Aim: To institutionalize CLEAN and SMART banking in PSBs.

EASENext: It would comprise 2 major initiatives:

- EASE 5.0 - common PSB reforms agenda

- Bank specific strategic 3-year roadmap based on individual bank’s business priorities.

EASE 5.0:

- Under EASE 5.0, PSBs will continue to invest in new-age capabilities and deepen the ongoing reforms to respond to evolving customer needs, changing competition and the technology environment.

- EASE 5.0 will focus on digital customer experience, and integrated & inclusive banking, with emphasis on supporting small businesses and agriculture.

Roadmap:

- All PSBs will also create a bank-specific 3-year strategic roadmap.

- It will entail strategic initiatives beyond EASE 5.0.

- The initiatives will be across diverse themes - business growth, profitability, risk, customer service, operations, and capability building.

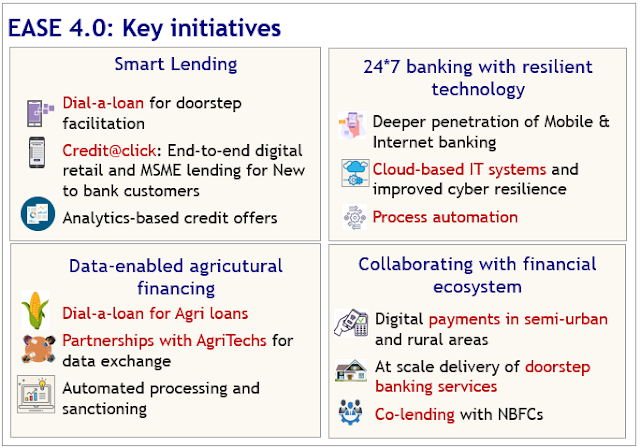

- Smart lending, which entails leveraging digital technology for providing instantaneous and simplified credit, continues to be an important focus of EASE 4.0

- PSBs have shown significant improvement on key digital lending dimensions such as sourcing and disbursement of p-segment loans through digital channels(Internet banking, Mobile Banking, Contact Centre, SMS, Missed call, and Website-based Chatbots), end-to-end digital lending, and analytics-based loans disbursement.

- PSBs have shown increased mobile app usage among their customers through awareness creation and improved performance of their primary mobile apps.

- PSBs have shown increased mobile app usage among their customers through awareness creation and improved performance of their primary mobile apps.

- Indian Banks Auctions Mortgaged Properties Information (IBAPI) portal is an initiative of Indian Banks Association under the policy of the Department of Financial Services, Ministry of Finance to provide a platform to provide details of mortgaged properties to be auctioned online by Banks, starting with PSBs

Evolution of EASE Reforms Agenda:

EASE Agenda was launched in January 2018 jointly by the government and PSBs.

It was commissioned through Indian Banks’ Association and authored by Boston Consulting Group.

EASE 1.0: The EASE 1.0 report showed significant improvement in PSB performance in resolution of Non Performing Assets (NPAs) transparently.

EASE 2.0: EASE 2.0 was built on the foundation of EASE 1.0 and introduced new reform Action Points across six themes to make reforms journey irreversible, strengthen processes and systems, and drive outcomes. The six themes of EASE 2.0 are:

- Responsible Banking;

- Customer Responsiveness;

- Credit Off-take,

- PSBs as UdyamiMitra (SIDBI portal for credit management of MSMEs);

- Financial Inclusion & Digitalization;

- Governance and Human Resource (HR).

Ease 3.0: It seeks to enhance ease of banking in all customer experiences, using technology viz.

- Dial-a-loan and PSBloansin59 minutes.com.

- Partnerships with FinTechs and E-commerce companies,

- Credit@click,

- Tech-enabled agriculture lending,

- EASE Banking Outlets etc.

EASE 4.0 commits PSBs to tech-enabled, simplified and collaborative banking to further the agenda of customer-centric digital transformation.

Following major themes were proposed under this:

24x7 Banking: Under EASE 4.0, the theme of new-age 24x7 banking with resilient technology has been introduced to ensure uninterrupted availability of banking services.

Focus on North-East: Banks have also been asked to come up with specific schemes for the North-East.

Bad Bank: Establishing NARCL and IDRCL to resolve high value NPA of Banking Sector.

- A bad bank is a bank set up to buy the bad loans and other illiquid holdings of another financial institution.

Raising Funds Outside the Banking Sector: With changed times, now industries have the option of raising funds even from outside the banking sector.

- Banks themselves are raising funds through various avenues. These new aspects need to be studied to target credit where it is needed.

Leveraging Fintech Sector: Fintech (Financial Technology), one such sector that can provide technological help to banks as well as can benefit from help from the banking sector.

Export Promotion: Banks will be urged to work with state governments to push the ‘one district, one export’ agenda.

Also Read: LiFE Movement- Lifestyle for the Environment

Also Read: Agnipath scheme for Armed Forces

Also Read: What is Jan Samarth portal?

Also Read: Ayushman Bharat Digital Mission and eSanjeevani

Also Read: PM CARES for Children scheme

Also Read: Prime Minister’s Employment Generation Programme (PMEGP)