RBI Grade B Recruitment 2023: RBI Grade B is a national-level government exam which is conducted by the Reserve Bank of India (RBI) for the aspirants who have been looking forward to being a part of the Banking sector.

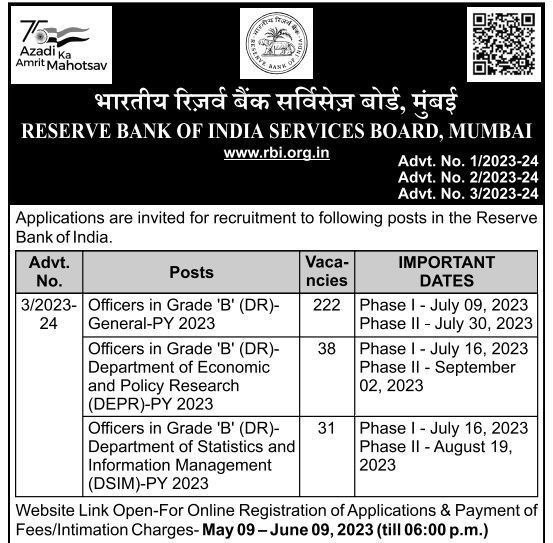

RBI Grade B 2023 Notification: The Reserve Bank of India announces vacancies for direct recruitment every year for the posts of officers in Grade B (DR) (GENERAL), officers in Grade B (DR) (DEPR) and officers in Grade B (DR) (DSIM).

RBI Grade B 2023 Exam Date: RBI Grade B 2023 notification has been released in Newspaper for 222 Posts and exams will be conducted in the month of July 2023.

Through this Article, we are simplifying the whole RBI Grade B Exam Process including RBI Grade B Exam Pattern, Syllabus, Previous Year Cut off, Books and Study Plan. Read the whole Article you will understand each and everything.

RBI Grade B 2023: Selection Procedure

RBI Grade B exam has three phases namely,

- Phase 1: Prelims,

- Phase 2: Mains, and

- Phase 3: Interview round.

Candidates are required to clear all three phases to get a confirmed post as a Grade B Officer in the Reserve Bank of India. The Final merit list will be based on candidates’ performance in the main exam and interview round.

RBI Grade B Exam Pattern (General) for Phase - I 2023

RBI Grade B Phase I is the primary screening process and hence, the score will not be added for the RBI Grade B Selection process. In the phase I exam, the aspirants have to answer objective-type questions. The exam will be conducted online.

Sections | Number of questions | Maximum marks | Allocated Time |

General Awareness | 80 | 80 | 25 minutes |

English Language | 30 | 30 | 25 minutes |

Quantitative Aptitude | 30 | 30 | 25 minutes |

Reasoning | 60 | 60 | 45 minutes |

Total | 200 | 200 | 120 minutes |

RBI Grade B Exam Pattern for Phase-II 2023

The Phase-II exam is an objective and descriptive type of online exam. The obtained score from this phase will be added for the RBI Grade B Final selection process. More precisely, the final RBI Grade B Cutoff will be prepared based on Phase-II and the interview score.

Name of Paper | Type of the Paper | Number of Questions | Time Duration | Maximum Marks |

Paper–I Economic & Social Issues | 50% objective type | 30 Objective Questions & 6 Descriptive Questions, out of which 4 have to be answered | 30 minutes (Objective) | 50 (Obj) |

Paper-II: English – Writing Skills | Descriptive Typing and the answers will need to be typed with the help of a keyboard | 3 (Descriptive) | 90 minutes | 100 |

Paper -III Finance and Management | 50% objective type | 30 Objective Questions & 6 Descriptive Questions, out of which 4 have to be answered | 30 minutes (Objective) | 50 (Obj) |

RBI Grade B Exam Pattern: Interview (Phase-III)

- Based on the aggregate score obtained in the Main exam (Paper-I +Paper-II +Paper-III), candidates will be invited for the interview round.

- RBI will decide the minimum cut-off which must be cleared by candidates in order to be shortlisted for the Interview round.

- Reserve Bank of India will publish the RBI Grade B result in a PDF format containing the roll number of candidates shortlisted for the interview.

- Candidates will receive interview call letters on their registered email ID.

- RBI Grade B Interview round will be 75 marks.

- Candidates can choose the medium for interview amongst Hindi or English languages.

- Final Selection will be based on the candidate's performance in the Phase-II examination and interview.

RBI Grade B Phase II Cut-off 2022

|

RECRUITMENT STAGE |

CATEGORY & CUT OFF MARKS |

|||||

|

GENERAL |

OBC |

SC |

ST |

EWS |

PwBD |

|

|

Aggregate Cut – Off Marks In Paper- I, Paper-II And Paper- III (Out Of

Total 300 Marks). |

171.25 |

167.00 |

150.50 |

150.25 |

171.25 |

150.25 |

|

Aggregate Marks in Written Examination (Paper- I, II And III) And

Interview Taken Together (Out Of Total 375 Marks) |

234.50 |

223.00 |

202.50 |

179.00 |

187.50 |

208.25(GEN) 196.75(OBC) 176.25(SC) |

RBI Grade B Phase 1 Cut-off 2022

Section | Category | ||||

General | EWS | OBC | SC | ST | |

General Awareness | 12.00 | 12.00 | 8.00 | 6.25 | 6.25 |

Reasoning | 9.00 | 9.00 | 6.00 | 4.75 | 4.75 |

English Language | 4.50 | 4.50 | 3.00 | 2.25 | 2.25 |

Quantitative Aptitude | 4.50 | 4.50 | 3.00 | 2.25 | 2.25 |

Total | 63.75 | 63.75 | 60.25 | 55.25 | 50.75 |

RBI Grade B Phase 1 Cut-off 2021

Section | General | EWS | OBC | SC | ST | PwBD (OH/HI/VH/MD) |

General Awareness | 16.00 | 16.00 | 12.00 | 10.25 | 10.25 | 10.25 |

Reasoning | 12.00 | 12.00 | 9.00 | 7.75 | 7.75 | 7.75 |

English Language | 6.00 | 6.00 | 4.50 | 3.75 | 3.75 | 3.75 |

Quantitative Aptitude | 6.00 | 6.00 | 4.50 | 3.75 | 3.75 | 3.75 |

Total | 66.75 | 66.75 | 63.75 | 53.50 | 52.75 | 52.75 |

RBI Grade B 2020 Cut-off Phase I

There was no exam conducted by RBI for Grade B Post due to Covid-19.

RBI Grade B 2019 Cut-off Phase I

Category | General Awareness (Total Marks = 80) | Reasoning (Total Marks = 60) | English Language (Total Marks = 30) | Quantitative Aptitude (Total Marks = 30) | Total Marks/ Aggregate = 200 |

General/ UR/ EWS | 20.00 | 15.00 | 7.50 | 7.50 | 122.00 |

SC | 14.25 | 10.75 | 5.25 | 5.25 | 108.00 |

ST | 14.25 | 10.75 | 5.25 | 5.25 | 108.00 |

OBC | 16.00 | 12.00 | 6.00 | 6.00 | 115.50 |

PWD (OH/ VH/ HI/ MD) | 14.25 | 10.75 | 5.25 | 5.25 | 108.00 |

RBI Grade B 2018 Cut-off Phase I

Category | General Awareness (Total Marks = 80) | Reasoning (Total Marks = 60) | English Language (Total Marks = 30) | Quantitative Aptitude (Total Marks = 30) | Total Marks/ Aggregate = 200 |

General/ UR/ EWS | 20.00 | 15.00 | 7.50 | 7.50 | 105.75 |

SC | 14.25 | 10.75 | 5.25 | 5.25 | 91.75 |

ST | 14.25 | 10.75 | 5.25 | 5.25 | 91.75 |

OBC | 16.00 | 12.00 | 6.00 | 6.00 | 95.75 |

PWD (OH/ VH/ HI/ MD) | 14.25 | 10.75 | 5.25 | 5.25 | 91.75 |

RBI Grade B 2021 Cut-off Phase II and Final Cut off

RBI Grade B 2019 Cut-off Phase II and Final Cut off

CUT-OFF MARKS DECIDED BY THE BOARD AT VARIOUS STAGES OF THE RECRUITMENT PROCESS: | ||||||

RECRUITMENT STAGE | Category | |||||

GENERAL | OBC | SC | ST | EWS | Pw BD | |

AGGREGATE CUT – OFF MARKS IN PAPER- I, PAPER II AND PAPER- III (OUT OF TOTAL 300 MARKS). | 193.25 | 188.00 | 172.25 | 172.25 | 193.25 | 172.25 ( HI, LD, MD) 176.75 (VI) |

AGGREGATE MARKS IN WRITTEN EXAMINATION (PAPER- I, II AND III) AND INTERVIEW TAKEN TOGETHER (OUT OF TOTAL 350 MARKS) | 238.25 | 215.50 | 206.50 | 194.00 | 197.00 | Gen 215.75 OBC 194.75 |

RBI Grade B 2023: Prelim Exam Syllabus

Reasoning Ability | Quantitative Aptitude | English Language |

Seating Arrangement - Linear, Circular, Rectangular, Parallel, Uncertain, some facing Inside Out and Some facing North-South Puzzle: Floor and Flat, Box, Scheduling (Days, Months, Year based), Category Based, Ranking Based, Blood Relation based, comparison based, Designation based Critical Reasoning: Argument – strengthening and wakening, Course of Action, Cause-Effect, Inference and Implicit based Questions. Other Topics: Syllogism and Reverse Syllogism, Input-Output, New Pattern Coding Decoding, Coded Inequality, Blood Relation, Direction Sense | Data Interpretation: Line, Bar, Pie, Table, Mixed, Missing Graphs and Caselets (Paragraph based DI) Data Sufficiency Calculation Based: Approximation, Number Series (Next, Wrong, Missing and Double series), Quadratic Equation, Quantitative Inequality Arithmetic: Average, Ratio-Proportion, Profit and Loss, Percentage, Partnership, Mixture and Allegation, Time and Work, Time and Distance, Permutation and Combination and Probability etc; | Reading Comprehension Cloze Test Para Jumble (Old and New Pattern) Sentence Completion (Table Based) Sentence Improvement Sentence Connector Vocabulary and Idioms Based Questions Some new pattern Questions Introduced by IBPS in recent exams. |

How to Prepare General Awareness for RBI Grade B

In RBI Grade B 2021 and 2022, 60% of Phase 1 current affairs questions and almost 100% of Phase 2 current affairs questions were from 4 sources:

- PIB releases

- RBI press release

- SEBI press release

- Reports and Indices.

In simple terms you need to understand that GA in phase I is not GA, its basically 40-50% Economic and Social Issue and 20% Finance of RBI Grade B Phase II syllabus, same applies in NABARD Grade A as in that exam too, Economics and Social Issue, Agriculture and Rural Development, apart from General Awareness contains many questions from above four sections. These are high "Return on investment" (ROI) current affairs.

Read About GA Preparation In Detail: Click Here

RBI Grade B 2023 Syllabus: Economics and Social Issue

Units and Sections | Topics under Units and Sections |

Growth and Development |

|

Indian Economy |

|

Budget and Economic Survey |

|

Globalization |

|

Social Structure in India |

|

RBI Grade B 2023 Syllabus: Finance

Units and Sections | Topics under Units and Sections |

RBI and Its Functions |

|

Regulators of Financial Sector and All India Financial Institution |

|

Banking System in India |

|

Financial Markets |

|

General Topics |

|

Current Affairs Based Topics |

|

RBI Grade B 2023 Syllabus: Management, Ethics and Corporate Governance

Units and Sections | Topics under Units and Sections |

Introduction to management |

|

Meaning & concept of organizational behaviour |

|

Motivation |

|

Leadership |

|

Organization and Organization Development |

|

Communication

|

|

Ethics |

|

Corporate Governance |

|

What changes must be brought in the RBI grade B preparation after the new pattern?

Change in Mindset – It is no more a 3-month preparation examination. It is a job at the Central Bank, it is a serious business. However, some commentators previous termed it as 3–6-month preparation examination. Start with your graduation or as early as possible.

Study in detail – Since the examination is no more a guess work anymore, you need to start studying in detail. you need to know details like facts, numbers and also reasons and history of any particular news items. While studying any news or related item make short pointers Importance, Reason, Advantages, Consequences, Challenges, Steps from Govt in this direction and what can be the possible way forward. It helps in building opinions and revision.

Develop reading habit – For this, follow quality websites like the Business Line, Business Standard, Live Mint, centralbanking.com, and also read some books not related to your preparation but related to Indian banking/finance industry. It helps in developing interest around the job you are aspiring. Plus, only if you are a good reader then only you can be a good writer.

Typing Answer or Articles – Start writing or rather typing. You need to match your thinking speed with your tying speed (Yeah, it important). This can only happen if you practice. Many of the youngsters are not used to keyboard typing and this can negatively impact their chances. Another reason for typing is to test yourself.

- Don’t keep it pending for the last three months, or to get “right topics” to answer. You shall start it “right now”, start writing summaries or critical analysis of anything you get on the internet/newspaper. It will only and only improve your ability to tackle questions “which you haven’t studied” in the exam.

- Don’t really wait for the assessment of your written answers from experts or coaching centers, use your friends, put it in telegram groups for open assessment. Accept the criticism and build on it.

Profile building – If you are sitting at home and doing nothing except preparation. It would be better to do any online course.

Courses - You should join online course only when you have made significant progress in your preparation and you have clarity about or are in ‘revision only’ mode.

What are the Books and Study Materials needed for Phase I

| Subjects | Books |

| English Language |

|

| Reasoning Ability |

|

| Quantitative Aptitude |

|

- Economics - Indian Economy by Vivek Singh

- Finance - M Y Khan and RBI FAQ

- Management - L M Prasad, Summary Sheet or Master Notes and Search Topics like Emotional Intelligence, Organization on Google

- Ethics and Corporate Governance - Summary Sheet or Master Notes and Search Google to make notes.

- Fundamental of Macroeconomy

- Money and Banking (Finance Syllabus)

- Money and Banking Part - II (Finance Syllabus)

- Government Budgeting (Union Budget)

- Indian Economy (1947-91) - Few Topics like Economics reforms need to be covered

- Inclusive Growth and Issues

- International Organization

- Infrastructure and Investment Model (Finance)

- Terminology